What are Cryptocurrency and Tokenomics?

If economics studies how societies allocate scarce resources, tokenomics studies how cryptocurrency blockchain networks do the same, except without governments, banks, or central authorities.

In economics, money is defined by what it does rather than the form it takes. It is anything that is widely accepted as a medium of exchange, store of value, and unit of account. Cryptocurrency, for example, is a form of money that doesn’t rely on traditional banks and governments to allocate and monitor it. Instead, transactions are recorded on a shared digital ledger that tracks every exchange and is maintained by a decentralized computer network. Once a transaction is added, it’s nearly impossible to alter, transparent, and secure through cryptography, ensuring that users can verify transactions without the need for middlemen, creating a trustworthy system.

Tokens, digital assets created using the blockchain’s smart contract system, are built on top of this blockchain. A token can represent almost anything:

- Currency

- Access to certain features of a platform

- Digital art

- Ownership in a project

- Voting power

These tokens can be interchangeable, like currency, or unique, like an NFT. The way these tokens are used and how they are designed boils down to tokenomics.

Why is Tokenomics Important?

For both investors and users, tokenomics is a crucial blueprint, revealing how a project:

- Distributes power

- Rewards participation

- Regulates supply

- Expands in the long-term

Good tokenomics promotes stability, growth and trust. Bad tokenomics fosters imbalance, manipulation, and even eventual collapse.

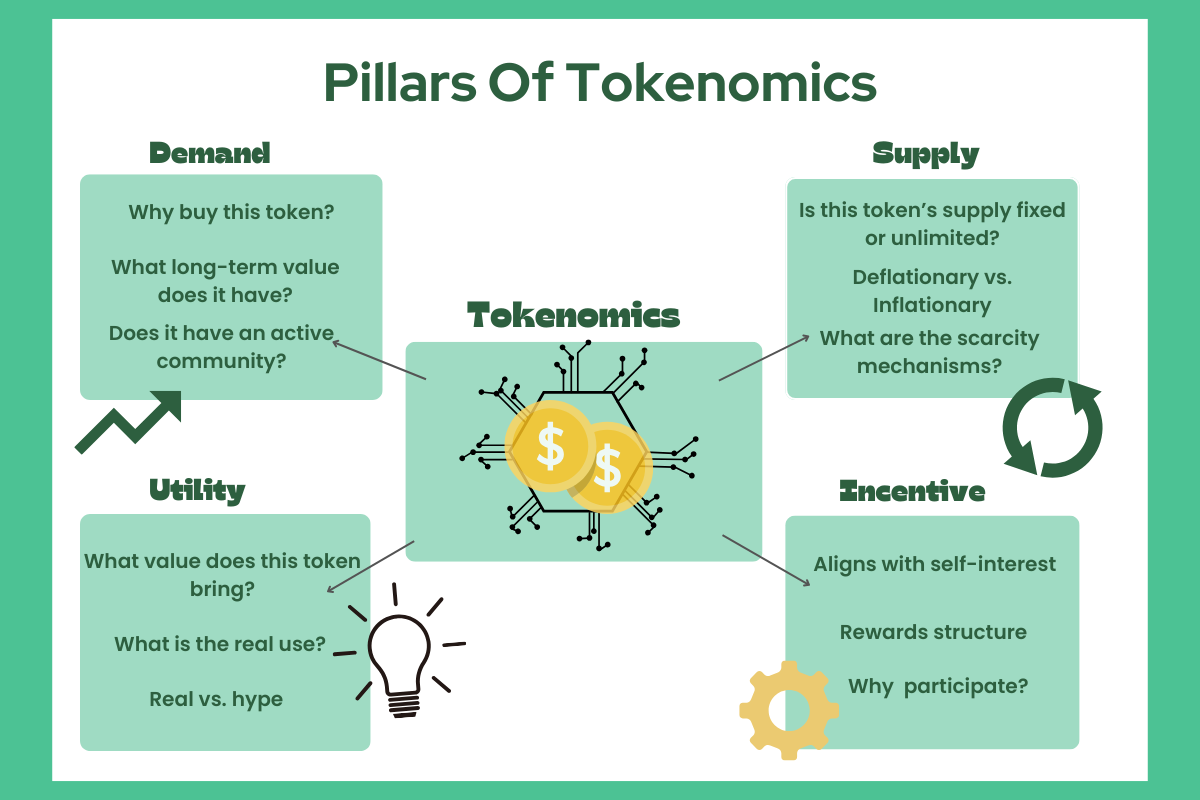

Analyzing Tokenomics

Token Utility

In economics, utility is defined as the measure of extra benefit someone gets as they consume a good or a service. In tokenomics, token utility works the same way, essentially. A token has utility if holding it or using it serves a meaningful purpose within its ecosystem. This could be, for example:

- Paying fees

- Owning a stake in a project

- Earning long-term rewards

Tokens that have no real or long-lasting utility tend to rely on hype, which rarely lasts.

Supply and Scarcity

Supply and scarcity matter just as much as utility. In some crypto projects, there is a set limit on how many tokens will ever exist, while other projects allow new tokens to be created over time.

Deflationary models focus on scarcity, often using a mechanism called token burning, which means permanently removing tokens from circulation by sending them to inaccessible addresses. Solana, a blockchain designed for fast transactions and low costs, burns a portion of every transaction fee.

Inflationary models mint brand-new tokens to reward participants who help to secure the network, like miners and validators.

In many modern projects, a combination of both deflationary and inflationary models are used to promote and balance growth and stability.

Incentive Structures

At the backbone of all this is a core economics concept: incentive. These crypto networks depend on people acting in ways that benefit the system, by first seeking to benefit themselves, especially when no central authority is watching.

- Bitcoin rewards miners with transaction fees

- Ethereum rewards users who stake their tokens to help validate transactions

Incentive structures, in any economy, must align self-interest to the benefit of the network, solving problems like freeloading and lack of participation.

Demand Mechanisms

Demand mechanisms can determine whether tokenomics either succeed or collapse. For every project, the key question is: why would someone willingly exchange money for this token?

Strong demand stems from:

- Clear use cases

- Active communities

- Systems that reward long-term participation over speculation

Weak demand leads to:

- Abandoned projects

- Empty promises

- Collapsing networks

Case Study: Ethereum

The tokenomics of Ethereum offer a useful example. Ether, the native token of the Ethereum network, is used to:

- Pay transaction fees

- Deploy smart contracts

- Participate in staking

While Ethereum doesn’t have a fixed maximum supply, its issuance is controlled carefully, and its utility is tied into the ecosystem built on top of it, which includes:

- Decentralized finance (DeFi) platforms

- NFTs (non-fungible tokens)

The value of Ether is inherently functional.

Future Applications of Tokenomics

DeFi, an abbreviation of “decentralized finance,” takes the ideas behind tokenomics and applies them to familiar financial services like lending, trading, and insurance. DeFi platforms utilize smart contracts, peer-to-peer deals that execute on the blockchain, to automatically enforce the rules of a transaction. Users are incentivized with tokens or fees to:

- Provide liquidity

- Validate transactions

- Take on risk

This turns participation into part of the economic system. It also makes DeFi more open and globally accessible, but also more fragile, since bugs in the code or poorly designed incentives can lead to major losses. In DeFi, strong tokenomics determines whether a protocol becomes a functioning financial system or collapses under its own incentives.

The Bottom Line

To sum it up, tokenomics is the essential economic framework behind every crypto project. Well-designed tokenomics leads to sustainable systems, but poorly thought-out tokenomics leads to system collapse. For further reading, check out the sources below!

Sources and Bibliography

- https://hacken.io/discover/tokenomics/

- https://www.blockpit.io/en-us/blog/tokenomics

- https://www.nansen.ai/post/what-is-tokenomics-analysis-guide-to-crypto-valuation

- https://info.arkm.com/research/tokenomics-a-beginners-guide

- https://www.exp.science/education/tokenomics-economic-blueprint-behind-digital-assets